Recent trends suggest that many venture capitalists are becoming more conservative or shifting gears due to general economic certainty. However, alarmists claiming that all venture capital has dried up are simply not correct.

There is still venture capital to be had, it’s just that trends are changing. As such, it’s valuable to explore those trends. What is hot amongst VCs right now? And what is less popular?

Let’s take a look!

The Situation With Web3

Cryptocurrency and web3 was an incredibly hot area of investment in the last year or so. However, following the cryptocurrency exchange FTX crash, this has changed drastically.

VCs poured over $18 billion into crypto and blockchain startups in the first half of 2022 alone.

This means that in the first half of 2022, three times more money was invested than in the entirety of the previous year.

2022 was looking like it would be a record breaking year for crypto investments from venture capitalists. However, funding plunged in the third quarter following the many legal issues surrounding infamous failure of FTX.

There has been significant ciriticism for VCs who rushed to pour funding into Web3. Some say it appears many were in such a rush to invest that they didn’t do their due dilligence, which has contributed to the many issues with Web3 businesses.

Some have even urged VCs to invest more heavily in startups that have more direct real world goals for improving human life. However, as you will see here, a lot of venture capital has been and is still going into such projects.

For now it appears funding into crypto has somewhat fizzled out, but it remains to be seen if that is the case permanently. There are some signs of crypto momentum.

For example, Andreessen Horowitz, one of the biggest crypto backers in Silicon Valley, announced a research center dedicated to the topic last year.

It is also likely that, at least for now, as crypto and web3 have taken a hit in popularity, VCs who still wish to invest are focusing on other niches.

But, what exactly are these new hot button topics in the world of venture capital?

Solar

If you want to learn more about the FTX situation, take a look at our blog post on the topic! However, outside of the negativity and legal issues surrounding FTX, there are a lot of hopeful things happening too.

In 2022, solar technology thrived, and it is unlikely it will slow down this year. Last year, 7$ billion in venture capital went to solar companies and projects.

A report by Mercom Capital Group shows that this is 50% more than went into solar in 2021.

There were more mergers and acquisitions in 2022 than there had been in about a dozen years. There were 128 transactions and 8 of them were worth more than 1$ billion.

However, while venture capital was strong in solar, other forms of corporate financing were weaker. Things like debt financing and public market funding showed declines of 13%.

According to Raj Prabhu, CEO of Mercom Capital Group, in 2023 we can potentially expect even more VC funding into solar. However, rising interest rates could possibly dampen their enthusiasm. He says:

“If we go all the way back to 2010, we never had a year over $2 billion until 2021. That’s pretty significant.”

Growing calls for energy transition as the effects of climate change become more apparent and deadly as well as the Inflation Reduction Act has created new interest in solar. All of the recent activity in mergers and acquisitions will likely also give more investors confidence.

Cybersecurity Smashed Venture Capital Records in 2021, Slid in 2022

According to data from Momentum Cyber, cybersecurity startups raised nearly $30 billion in 2021. That was double the amount they raised in 2020.

Investors poured this record amount of financing into more than 1,000 deals, of which 84 were greater than $100 million. This includes the $200 million Series D investment secured by industrial cybersecurity startup Dragos, Claroty’s $140 million pre-IPO raise and the $543 million Series A raised by passwordless authentication company Transmit Security.

According to Momentum, this was largely fueled by rapid innovations and the surge of cybersecurity threats fueled by the pandemic. In 2021, more than 30 cybersecurity startups hit valuations of $1 billion or more. This includes companies like Wiz, Noname Security, and LaceWork.

We also saw some high-profile acquisitions and mergers. For example, Advent acquired McAfee for $14.1 billion. Avast and NortonLifelock also had an $8 billion merger in 2021.

Throughout 2022, funding cooled a bit in the world of cyber security. However, it is hardly a dead industry. At the same time, it is not immune to the wariness of investors in uncertain economic times.

According to Ofer Schreiber, partner and head of the Isreal office for cyber venture firm YL Ventures:

“The market’s fluctuations have affected all tech sectors. We’ve definitely seen reactions in the cybersecurity sector that coincide with the general wariness of both investors and vendors.”

However, there were still some big funding rounds, especially in the third quarter of 2022. For example, San Francisco-based cyber insurance startup Coalition closed a $250 million round at a $5 billion valuation.

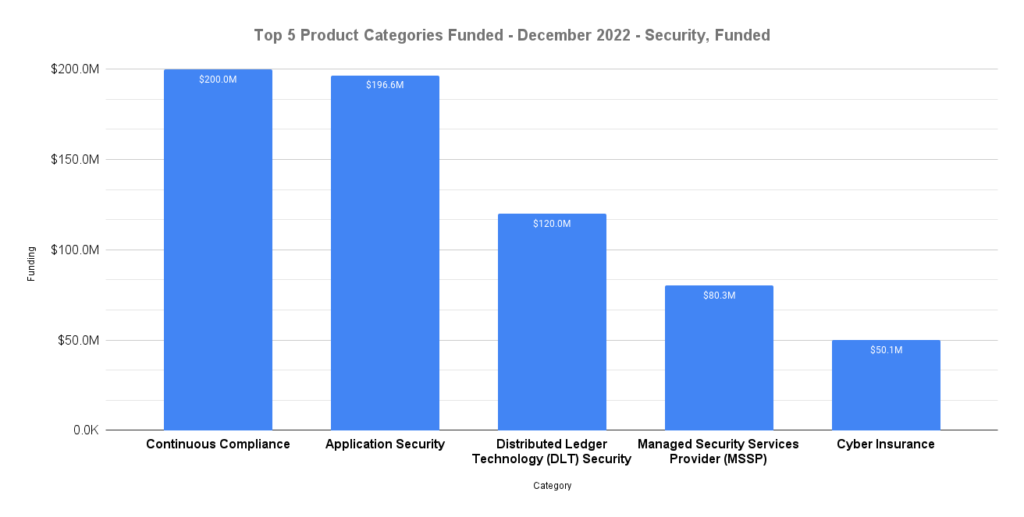

There is still investor interest, especially as cyber security threats become an increasing global concern. These were the top funded product categories in cybersecurity in December of 2022:

European VC Investment Is A Success Story Overall

Investment in Europe was quite strong in the first quarter of 2022.

Despite the war in Ukraine and global financial fears, Venture Capitalists invested over 27 billion euros into European startups in 2022.

Fintech was especially strong in Europe, led by London’s Checkout.com and France’s Qonto. The UK and Ireland led Europe when it came to VC investment.

However, in the third quarter, European venture funding hit its lowest point in 2 years.

Funding for the third quarter in Europe totaled $16 billion, down 44% year over year from $28 billion and down 35% quarter over quarter from $24 billion, per an analysis of Crunchbase data.

However, as 2022 closed, there were numerous promising developments in the European startup ecosystem. For one, in 2022 as a whole there was still record-breaking investment. And, Pan-European Venture Capital Fund Speedinvest announced a new 5 million euro fund last month.

This fund was created specifically to help European startups scale and 90% of the funds were already committed by investors at the time of launch.

According to Oliver Holle, CEO and Managing Partner at Speedinvest:

“In just ten years, Speedinvest has grown from a small €10M Austrian fund to one of Europe’s largest Seed investors. This new capital proves there is still room to innovate in European VC. As more and more capital and talent floods the ecosystem, further professionalization of our industry is required.”

2022 Was Rough for the Electric Vehicle, How Are Things Looking in 2023?

In the first half of 2022, Electric Vehicle Startups raised about $5.8 billion. In the previous year, in the same amount of time, they had collectively raised nearly $8 billion.

This led some to question what was happening in the EV space. For one, there were significant problems at Tesla, the largest and most famous EV maker in the US market.

Also, other large EV startups like Lucid Motors and Rivian, had achieved billion-dollar valuations in the past only to become public companies. Public companies no longer rely on venture capital heavily.

According to Garrett Nelson, a senior equity research analyst covering the automotive sector at the research firm CFRA, there are several reasons why VCs began to think of electric vehicle startups as more risky investments.

“You see it in the valuations that contracted enormously across the space, You look at some of the more successful startups and the struggles they’ve been having to ramp up production, like Rivan and Lucid. And I think it’s given a lot of VC investors pause in terms of giving additional investment in the space.”

On top of this, some are starting to consider oversaturation in the EV market, which would lessen returns significantly. Many companies are expected to release new electric vehicles in the US in 2023 and beyond.

In the US, electric vehicle investment and production of cars and batteries have started to ramp up again. According to an NRDC-commissioned report conducted by researchers at Atlas Public Policy:

The United States is now poised to attract the most investments globally in electric vehicle and battery manufacturing, for the first time surpassing announced investments in China and closing in on Europe. Companies have announced $210 billion of investments in the electric vehicle (EV) industry, up from just over $50 billion when President Biden took office in 2021.

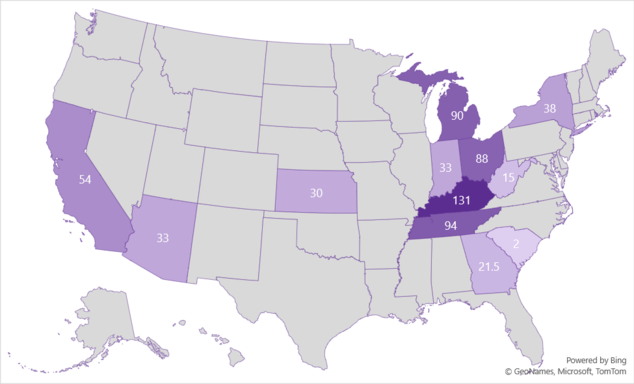

In fact, Atlas researchers also found that automakers and battery manufacturers have plans to spend $54 billion to construct or expand 37 EV battery manufacturing facilities domestically over the next several years in these states:

Final Thoughts on Where Venture Capital is Going in 2023

As you can see, while many reported only doom and gloom in the past year, it’s a little more complicated than that. Venture Capitalists have not exactly pulled all funding from every niche out of economic fears.

Venture Capitalists and firms are still investing in the global startup ecosystem. However, how much and where they invest are changing. This is normal to an extent over time. As the world, global economy, and trends shift so does the flow of venture capital.

There are exciting things happening around the world when it comes to startups and venture capital. Also, something it is very important to remember for new startups is that most businesses will never receive venture capital, regardless of market conditions.

The fact of the matter is: the majority of startups fund their ideas with savings, cash flow, crowdfunding, and taking on debt. Only 0.05% of startups raise venture capital.

While shows like Shark Tank have convinced many people that the only path to success is getting a wealthy investor to instantly skyrocket you to success, the truth is: that almost never happens.

So, if you want to get started, do it!

What do you think? Comment below.

Since 2009, we have helped create 350+ next-generation apps for startups, Fortune 500s, growing businesses, and non-profits from around the globe. Think Partner, Not Agency.

Find us on social at #MakeItApp’n®